Nine Entertainment Co. Leverages Sports Broadcast and Streaming Growth in FY25

Nine Entertainment Co. (ASX: NEC) has released its FY25 interim results, revealing a strategic focus on sports content as a key revenue driver amid a challenging advertising landscape. Despite a 15% decline in Group EBITDA to $268 million, Nine’s sports coverage—notably its Olympics and Stan Sport offerings—has underpinned growth in streaming, digital subscriptions, and licensing revenue.

Olympics Coverage Fuels Total TV Growth

Nine’s coverage of the 2024 Paris Olympics boosted its Total Television segment, contributing to a 2% revenue increase to $613 million. Streaming revenue through 9Now surged by 28%, driven by increased live viewership and catch-up engagement.

While free-to-air (FTA) broadcast revenue declined by 3%, Nine maintained a dominant 42.1% share of the Metro FTA advertising market—a record high for any network during a December half-year period. Nine’s regional advertising revenues also outperformed broader market trends, declining just 2% compared to a 5% drop across the sector.

Stan Sport Gains Traction with Major Rights Deals

Stan’s revenue rose 7% to $245 million, with a substantial contribution from Stan Sport—which benefited from rights acquisitions such as the UEFA Champions League, Wimbledon, and Rugby Championship. Despite increased costs tied to its expanded sports portfolio, Stan Sport saw higher-than-expected subscriber retention, reinforcing its value proposition in the Australian sports streaming market. Overall, Stan’s EBITDA grew by 16% to $29.4 million, marking a record first-half result.

Digital Growth and Strategic Sports Content Investment

Nine’s continued investment in premium sports content aligns with its broader push toward digital-first revenue models, with digital revenue now accounting for ~50% of total group revenue. The company’s digital and streaming expansion was complemented by a 15% growth in digital subscription revenues at its publishing mastheads, led by The Age, The Sydney Morning Herald, and The Australian Financial Review.

The media giant’s $35 million cost efficiencies in H1 FY25 have helped offset some of the economic headwinds affecting traditional advertising markets. Nine expects to surpass its $50 million FY25 cost-saving target, positioning it for continued investment in sports content and digital innovation.

Looking Ahead: Sports Rights and Market Expansion

Looking to the remainder of FY25, Nine is betting on its premium sports rights portfolio to maintain audience engagement and advertising revenues. The Australian Open’s audience grew by 5% YoY, and flagship programming like Married at First Sight saw a 23% increase in Total TV viewership, reinforcing the synergy between sports and entertainment content in Nine’s growth strategy.

Furthermore, Nine is set to explore additional monetisation opportunities through AI-driven content delivery, expanded sports partnerships, and digital advertising innovations. These initiatives align with its broader goal of leveraging the power of its Integrated Audience Platform to drive sustained growth in Total Television and digital segments.

Conclusion

As traditional TV advertising faces headwinds, Nine Entertainment Co. continues to adapt by capitalising on sports-driven content and digital transformation. Its record-breaking Olympics coverage, Stan Sport’s subscriber growth, and strong Total TV performance highlight the increasing importance of sports as a commercial pillar for the network. With strategic cost savings and a focus on digital expansion.

Similar Stories

New England Revolution Partner with Más Latino to Broadcast 2025 Home Games on Spanish Radio

The New England Revolution has announced a landmark partnership with Más Latino, designed...

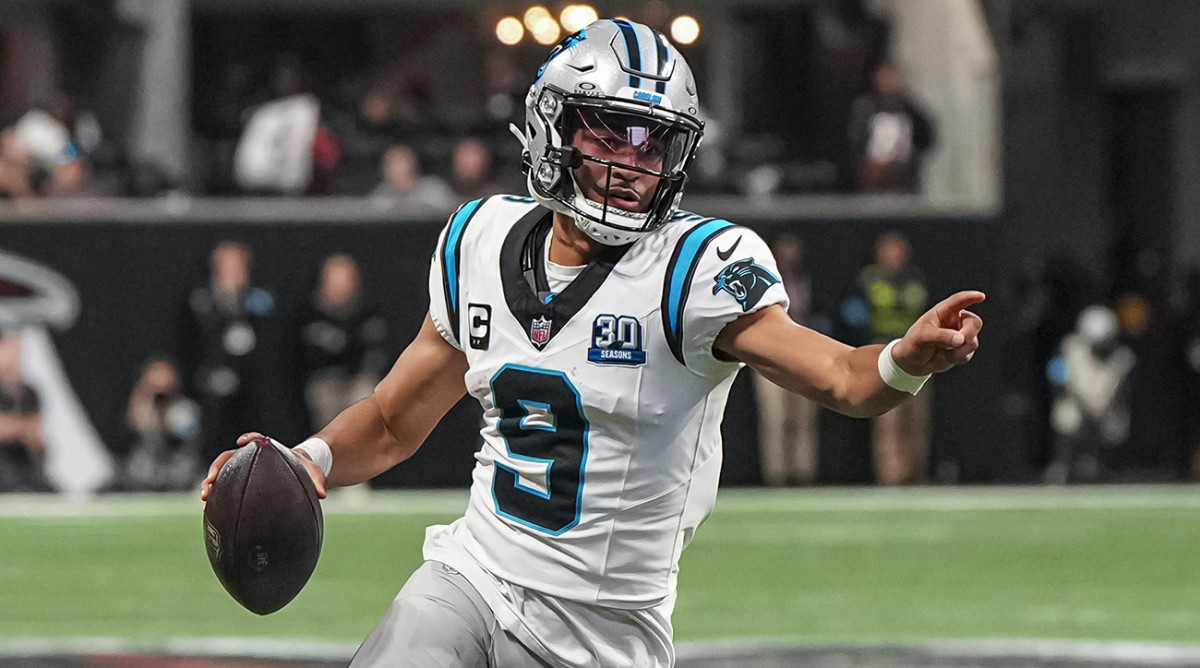

Carolina Panthers Fan Fest Returns to Bank of America Stadium

The Carolina Panthers have confirmed the return of their annual Fan Fest at...

Carolina Panthers and Telemundo partner to broadcast 2025 preseason games

The Carolina Panthers have announced a regional broadcast partnership with Telemundo, the Spanish-language...

It's free to join the team!

Join the most engaged community in the Sports Business World.

Get all the latest news, insights, data, education and event updates.